Throughout history, international monetary systems have evolved every few decades, from the gold standard to the Bretton Woods system and eventually to the current free-floating system with the US dollar as the dominant currency. Although rumors of a new gold-backed currency emerged at a recent BRICS summit, the dominant position of the US dollar remains largely unchallenged. Time will tell whether a gradual shift away from the dollar will happen in the more distant future owing to potential changes in payment preferences and digital currencies.

Martin Feldkircher and Viktoriya Teliha

19 September 2023

Chinese version | Russian version

Background: Monetary systems in the past.

Throughout history, about every 30 to 40 years, a new international monetary system emerges. Under monetary order relates to how countries can settle their trade balances that arise through the international exchange of goods and services. These monetary systems transitioned from a gold standard (fixed exchange rates between currencies that are backed by gold) to a gold exchange standard (only for countries with gold-backed currencies), to the Bretton Woods system (only the USA with gold-backed money) to a free-floating system (no backing at all). The latter has existed since the 1970s, with the world’s leading currency being the US dollar. Now, the time seems ripe for a change. Will a new global currency or even a new monetary order emerge?

International Role of present dominant currency.

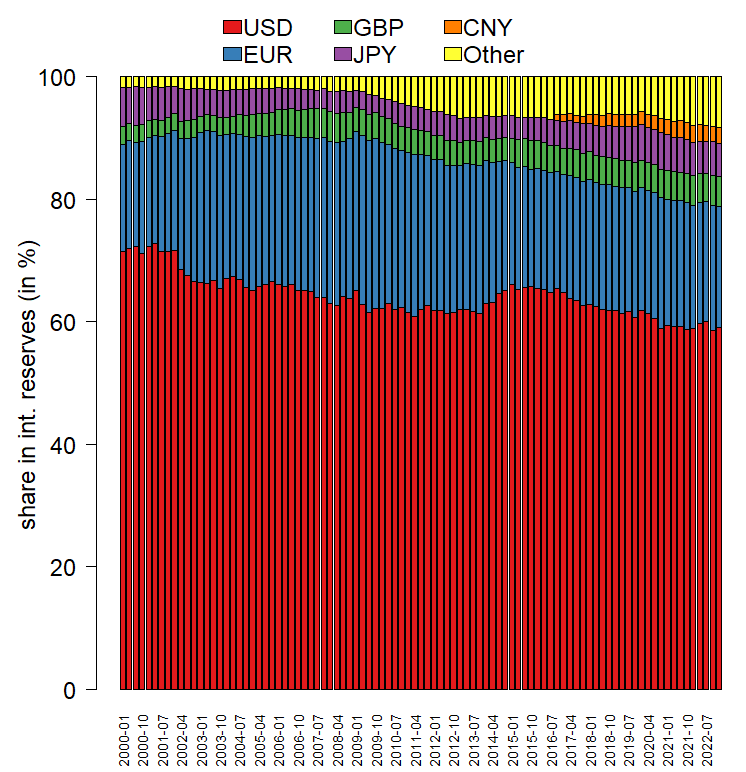

An essential role of a currency is its ability to serve as a store of value, namely, whether the currency can be preserved and accessed in the future without experiencing a substantial erosion of its buying power. An indicator of a currency’s credibility as a store of value is its inclusion by other central banks in their foreign exchange portfolio. Central banks hold foreign reserves, mainly in the form of other countries’ government bonds and in accounts at foreign central banks. Typically, trust and credibility among central banks is high – Some of them might switch to gold. That said, looking at actual data, the US dollar remains the world reserve currency (see Figure 1a). Its first contender, the euro, lags significantly behind. Since 2015, the US dollar’s share as a reserve currency has modestly declined, with some central banks buying non-traditional currencies such as the Chinese renminbi (CNY) and other less prominent reserve currencies (Arslanalp, S., Eichengreen, B., and Simpson-Bell, C. 2022. The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies. IMF WP/22/58). This can be attributed to portfolio managers’ risk diversification and is unrelated to current geopolitical tensions.

Figure 1a

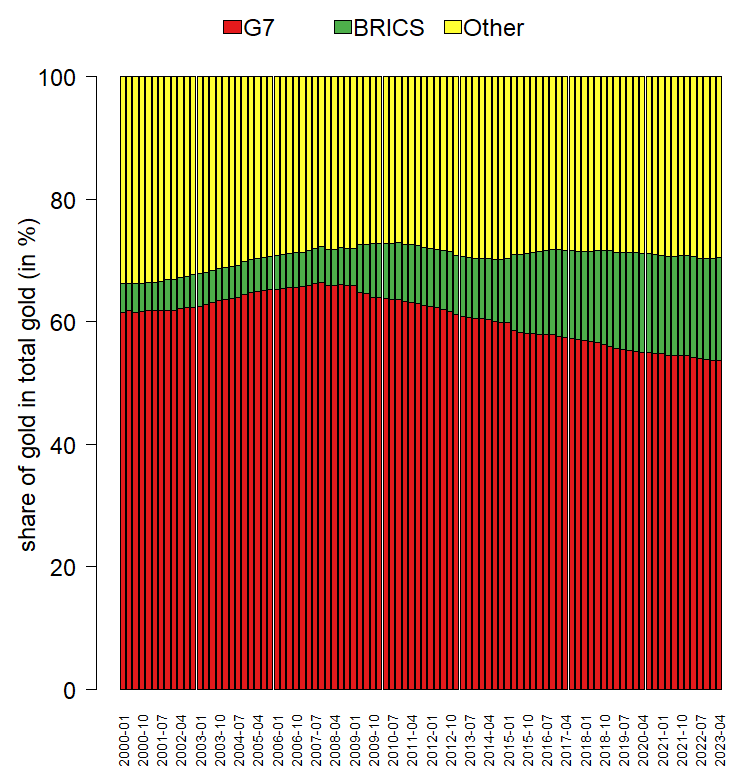

Figure 1b

Figure 1a shows the currency composition of international reserves held by central banks. Figure 1b show the central bank holdings as a share of global gold holdings. Source: IMF.

Figure 1b shows the share of the G7 and BRICS countries’ gold holdings as part of total gold holdings by central banks. This indicates that the G7 countries have steadily decreased their gold holdings compared to the rest of the world, while the BRICS countries have accumulated gold reserves. As opposed to bonds, gold does not pay interest, but is an excellent store of value. As noted by the ECB and the World Gold Council (2023), these figures are likely to underreport the extent to which gold has been bought by members of the BRICS, in particular Russia, since data to the IMF is reported on a voluntarily basis only (ECB. 2023. The international role of the euro. https://www.ecb.europa.eu/pub/ire/html/ecb.ire202306~d334007ede.en.html).

The international role of a currency can also be measured by its use as a medium of exchange. A company exporting goods or services to a large market has to use the currency its competitors use as invoice currency. Exporters to large economies mainly compete with domestic firms. It is, hence, not surprising that companies trading with the USA (must) use the USD as invoice currency. A similar case applies to trade with the Euro area, especially with neighboring, non-Euro area countries. But it is not only exporters who sell to the USA that use the dollar. A prominent example is that of oil exporters invoicing primarily in the US dollar, the so-called Petrodollar arrangement.

Owing to its wide acceptance and global investment opportunities, many firms prefer settling trade in US dollars. This implies that financial products to hedge against exchange rate risks are readily available, and financial markets offering these products, such as dollar funding, are highly liquid. This results in a lock-in effect, which makes it very hard to contend with the US dollar’s status as a global invoicing currency. In general, data on trade invoicing are scant, but recent research indicates that half of global exports are invoiced in US dollars (Gerding, F. and J. Hartley, De-Dollarization? Not So fast. 2023. Available at SSRN: https://ssrn.com/abstract=4477009). This percentage can be even higher for the Americas and Asia-Pacific region (Arslanalp et al., 2022). Taken at face value, this implies that although the US dollar lost some ground, it is still the dominant global currency and by a large margin.

Costs and benefits of maintaining the US dollar as a world currency

Economists very often talk about financing a trade deficit by borrowing from abroad. A trade deficit arises if a country imports more goods and services than it exports. One interpretation is that the country “lives beyond its means”, since it consumes more than it produces, and this excessive consumption must be financed by borrowing from abroad. Since the US dollar is the dominant global currency, the US economy can borrow very cheaply, which is sometimes referred to as the exorbitant privilege. On top of that, the strong demand for US dollars allows the USA to borrow from abroad in dollars rather than in foreign currencies, which implies that the debt is not exposed to exchange rate volatility. This is a privilege that other countries do not have. The flip side is that the US faces less pressure to correct its imbalances. Other countries with a current account deficit need to borrow at higher costs, which contains their abilities to accumulate foreign and domestic debt as well astheir demand for imports. This self-correcting mechanism is absent in the USA, which can potentially facilitate the build-up of asset bubbles or unsustainable debt developments.

Facts and Rumours from the BRICS summit

Against this backdrop, this year’s summit of the BRICS countries (Brazil, Russia, India, China, and South Africa) took place in August in South Africa. Rumours had it that the BRICS would propose a new gold or commodity-backed currency, potentially based on less trust in the US dollar because of the recent US sanctions policy. Proponents of a commodity-backed currency argue that the global money supply has grown too fast. More money chasing the same amount of goods naturally leads to inflation and a loss of purchasing power – a phenomenon witnessed in many economies. A commodity/gold-backed currency cannot be produced as easily since it depends on the abundance of the underlying resource.

The outcome of the summit, however, was quite different. The highlight was the agreement to admit six new member countries to form the BRICS+: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates, all joining officially in January 2024. The alliance of these countries can be considered the new powerhouse of the global economy. That said, the economic outcome regarding a switch away from the US dollar was less spectacular, and the hype about rumours of creating a new currency turned out to be unfounded. Nevertheless, the BRICS stated their intention to facilitate the use of national currencies for trading, with the recent rupee oil transaction between India and the United Arab Emirates constituting a critical signal to the rest of the world.

Outlook and conclusions

So far, the US dollar remains the world’s dominant reserve currency. It is widely used in trade, and global investors, public and private, continue to hold significant amounts of US dollar assets in their portfolios. Economic theory predicts that network and lock-in effects ensure that this status will not be changed easily. Weiss (2022) discusses that fears of a flight from the US dollar, caused by ongoing geopolitical tensions, seem unfounded, as close to three-quarters of foreign government holdings of US assets are held by countries with some military ties to the USA (Weiss, C. 2022. “Geopolitics and the U.S. Dollar’s Future as a Reserve Currency”, International Financial Discussion Paper). Moreover, other prominent reserve currencies (e.g., the Euro, Japanese yen, and British pound) are also issued by countries with close ties to the USA. Thus, geopolitical adversaries lack alternatives to the US dollar, and the BRICS summit did not offer any solution in this regard. Things might change over the medium term. Changes in payment preferences towards private and public digital currencies and new payment platforms might change the payment landscape. That said, a decrease in the exorbitant privilege of having the dominant world currency might not necessarily be bad for the US economy. It might lead to more sustainable growth and trade policies, which also benefits the global economy.